Before we delve into this article, readers should note that timing is of the essence for all things EI. EI (Employment Insurance) benefits change regularly. This is particularly true right now.

This article is being written in June, 2021. At this time, there are several COVID-19-related EI measures in place. These measures are temporary – they are in effect until September, 2021. The Government may choose to modify, extend, or end these measures at that point in time.

You should also note that this article pertains to regular EI benefits – it will not touch on special EI benefits, like maternity, parental, sickness, and compassionate care benefits.

Minimum and maximum weeks claimable

EI is normally claimable for 14-45 weeks. Currently, the maximum number of weeks that EI can be claimed for has extended to 50 weeks.

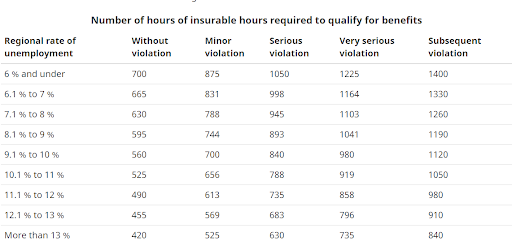

Generally, you need between 420-700 insured hours to claim EI. If you’re not sure how many insured hours you’ve worked, read through the Government of Canada’s insurable hours page.

Until September, 2021, however, this number of hours is reduced to 120. This is because the Government of Canada is providing a 300-hour credit to anyone claiming regular EI benefits.

Let’s elaborate on this a bit. You’ll note that we mentioned 420-700 insured hours are required to claim EI – normally, this is based on the unemployment rate in your area. The higher the unemployment rate, the lower the barrier to claiming EI.

Until September, 2021, all areas are considered to have a minimum unemployment rate of 13.1%. This means that even if your area’s unemployment rate is lower than 13.1%, it’s considered to be 13.1% for the purposes of EI eligibility. If your area’s unemployment rate is higher than 13.1%, the higher rate prevails. You can find your area’s unemployment rate using EI’s Economic Region Postal Code Search.

With the 13.1% minimum unemployment rate established, we can see how many hours you may be entitled to, based on how many hours you’ve worked. Remember, the minimum is 120, and all workers claiming EI receive a 300-hour credit, so you can effectively subtract 300 from all of the required number of hours.

You can find the table of regular benefits payable on the benefit amounts page. You only need to look at the 13.1% and above columns, as 13.1% is the current minimum.

A note on EI violations

It’s worth noting that if you’ve received violations related to EI, the minimum hours you need to work increases. This chart shows you the hours you need with a violation. Remember that you’ll get a 300-hour credit and that all regional unemployment rates are considered 13.1%, regardless of prior EI violations.

There are quite a few considerations we haven’t covered in this article, including the Canada Recovery Benefit (CRB) and the aforementioned special EI benefits. If you’re curious about those, send us an email – with enough interest, we can develop another article on those subjects. We’re Compass Accounting in Winnipeg, and we’re here to help you make sense of money.