Finding a professional to work with your business can be a daunting task. The goal is to find someone who understands complex and arcane systems that are integral to your businesses success; lawyers, software developers and accountants, to name a few. The problem is, if those systems aren’t in your wheelhouse, it can be hard to tell who is right … Read More

Understanding China’s Canadian Canola Ban

For any company looking to export its goods overseas, the Chinese market is incredibly attractive. The country has the highest population in the world, which means plenty of potential consumers; they’re also seeing some of the highest rates of GDP growth in the world, and their middle and consumer classes are growing rapidly. The country can be a bit fickle, … Read More

Basic February Tax Overview

February is a wonderful month. We have the Festival du Voyageur, where we can warm our hearts and celebrate Franco-Manitoban and Métis culture and heritage. We have Valentine’s Day, when we can express our love for those who matter the most to us. Above all in the world of accounting, February is, in most people’s minds, the start of tax … Read More

Business Use of Home and Other Handy Home Business Write-Offs

Running a business out of your home can be incredibly fulfilling. Think about all the different businesses that have started in someone’s garage; most of today’s uber tech giants were started as home businesses. That means there’s no telling how large your home business will grow – you might have to move out of the bedroom office you’ve made for … Read More

Why You Should Switch to Cloud Accounting

Those of you reading this are probably still using old accounting methods. Plug all of your numbers into an Excel spreadsheet, print them out, bring them over to your accountant, wait, have the accountant return the spreadsheets, evaluate, make appropriate changes. Rinse and repeat. Okay, to be honest, I sincerely hope none of you are printing Excel spreadsheets; hopefully you … Read More

From the Ashes

Small businesses don’t always work out. There are so many factors at play: maybe it wasn’t the right time to move your product to market, maybe there was an unexpected breakdown in the supply chain. New taxes might have sliced into your profit margins enough that you couldn’t keep the business going, or a new technology might have rendered your … Read More

Balance

The world is filled with stressors. This is in many ways especially true for small business owners, who may feel like they need to be hands-on in every element of their company. You’ve made the business from the ground up, with your own two hands, invested time, money and energy into creating something great. With so much of yourself in … Read More

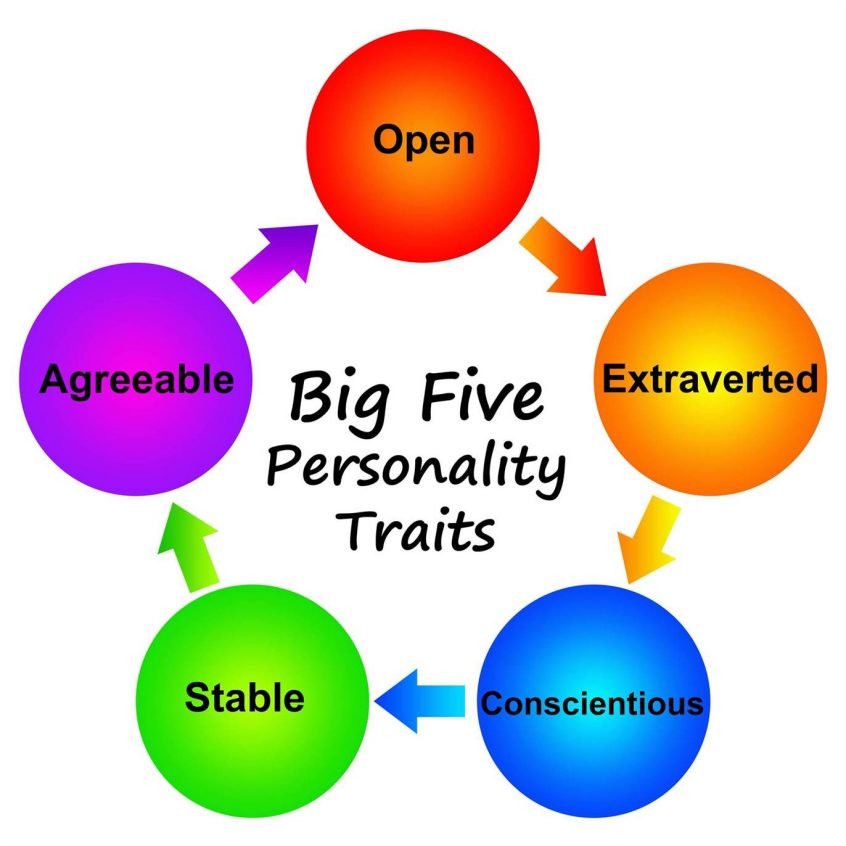

The Big Five and Business, Part II

A quick summary for those who didn’t read the first post: there’s a personality inventory called the Big Five, and it evaluates people’s personalities based on five facets: Openness to Experience, Conscientiousness, Extroversion, Agreeableness and Neuroticism. During our last post, we discussed how the first three facets can affect the well-being of your small business. In brief, Openness is good … Read More

The Big Five and Business, Part 1

The Big Five personality traits are five traits (what a surprise) developed by psychologists that seem to account for a great deal of an individual’s personality. The five traits are Openness to Experience, Conscientiousness, Extraversion, Agreeableness, and Neuroticism. Each of the five can have an effect on the success of a business; when starting a business, it might be a … Read More

Change

Change is inevitable. Being alive is change, down to the minute biological processes that make us tick. While change is very much a part of us, it can be something we’re incredibly resistant to. Comfort is necessary; without some level of consistency in our lives, it can be difficult to find a sense of ease or a sense of self. … Read More